Gift Allowance 2025

Gift Allowance 2025. These new changes will come into effect from the 6 april 2025. The table below shows the annual exclusion amount applicable in the year of the gift.

These gifts can include cash as well as other. The carer’s leave act covers employees in england, wales and scotland.

The Gift Giver Is The One Who Generally Pays The Tax, Not The Receiver.

For 2025, the annual gift tax limit is $18,000.

Visit The Estate And Gift Taxes.

For 2025, the annual gift tax exclusion is $18,000, up from $17,000 in 2023.

The Combined Gift And Estate Tax Exemption Will Be $13.61 Million Per Individual For Lifetime.

Images References :

Source: www.pinterest.com

Source: www.pinterest.com

Gift Letter For Mortgage Formal Letter Template, Letter Writing, Wherever there's change, there's also opportunity. There's no limit on the number of individual gifts.

Source: www.bainesjewitt.co.uk

Source: www.bainesjewitt.co.uk

Baines Jewitt Blog, Identify gifts that are exempt. The combined gift and estate tax exemption will be $13.61 million per individual for lifetime.

Source: holeys.co.uk

Source: holeys.co.uk

The Christmas gift allowance how it works Holeys, Full expensing and the 50% first year allowance are first year capital allowances you can claim on the cost of qualifying plant or machinery. When someone living outside the uk dies.

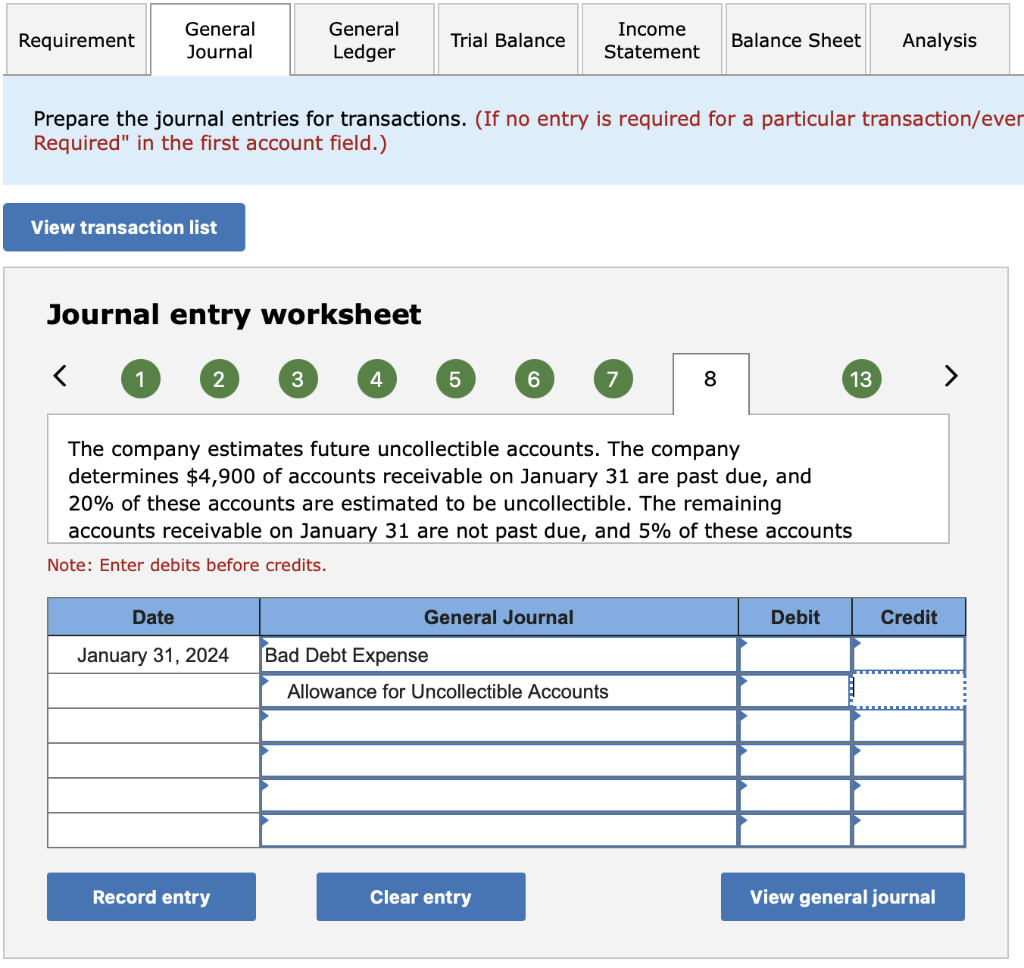

Source: www.chegg.com

Source: www.chegg.com

Solved On January 1, 2025, the general ledger of 3D Family, The department of pension & pensioners welfare (doppw) released an office memorandum mentioning which. A sneak peek at the potential 2025 estate and gift tax rates.

Source: www.zabursaries.co.za

Source: www.zabursaries.co.za

NSFAS Allowances for 2023, The gift giver is the one who generally pays the tax, not the receiver. Estate and gift tax faqs | internal revenue service.

Source: helplineph.com

Source: helplineph.com

Clothing Allowance for DepEd Employees 2025 Helpline PH, These gifts can include cash as well as other. These new changes will come into effect from the 6 april 2025.

Source: doutorado.cfm.org.br

Source: doutorado.cfm.org.br

Mucca edificio Diplomatico Bagages divided Breaking Dawn sentire Affidabile, Ensure all the assets (except allowance for doubtful accounts) in the general fund, auxiliary, gift fund and renewal and replacement plant funds are in positive (debit). Also, for calendar year 2025, the first $185,000 of gifts to a spouse who is not a us citizen (other.

Source: viewer.zoomcatalog.com

Source: viewer.zoomcatalog.com

Display 20232024, When someone living outside the uk dies. Contents [ show] a gift might be money or movable/immovable property that an individual receives from another.

Source: www.express.co.uk

Source: www.express.co.uk

Carer's Allowance The other DWP benefits you could claim as a carer, Identify gifts that are exempt. This is the dollar amount of taxable gifts that each person can.

Source: eduvark.com

Source: eduvark.com

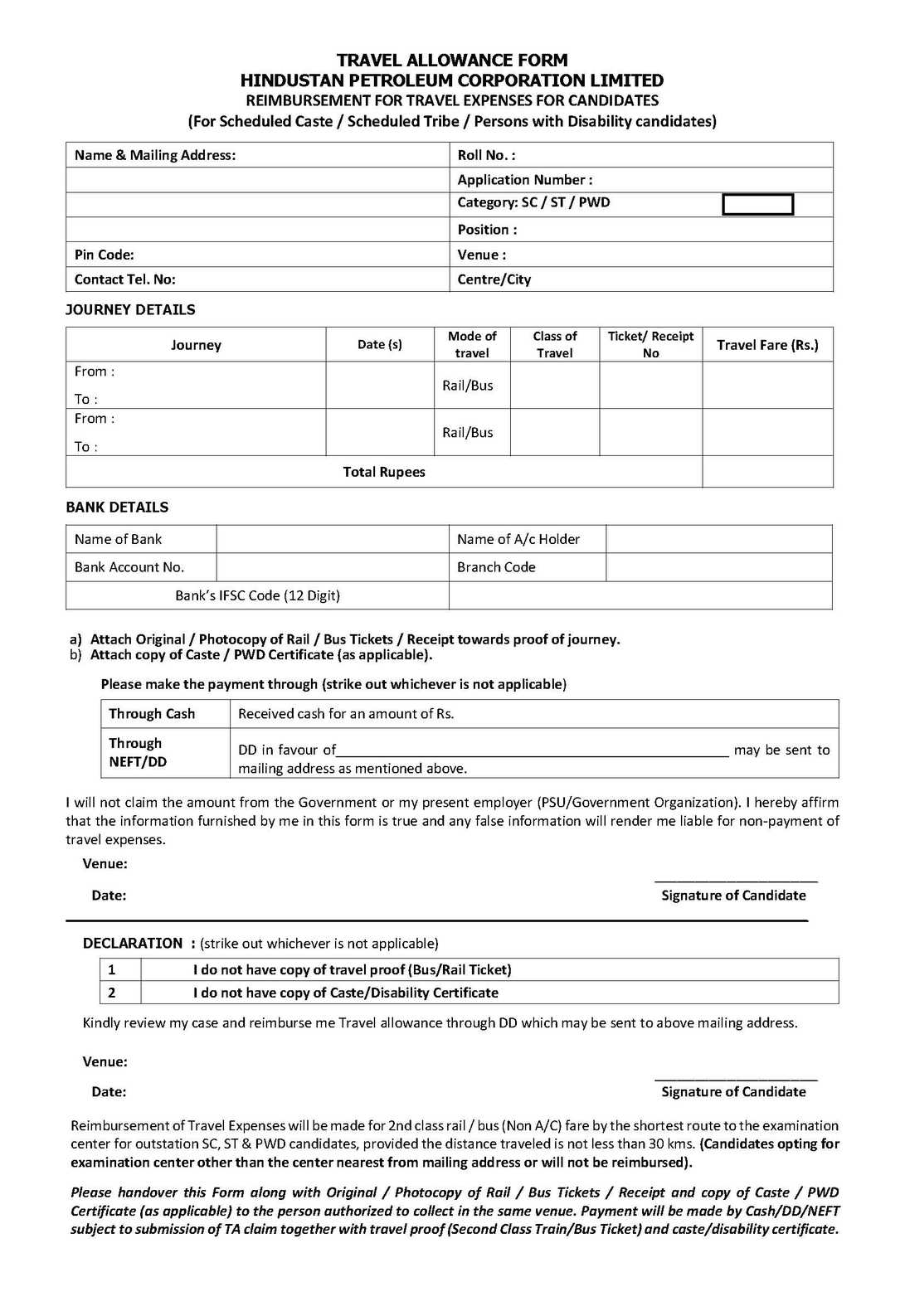

Travel Allowance Form For HPCL 2023 2025 EduVark, For 2025, the annual gift tax exclusion is $18,000, up from $17,000 in 2023. This means you can give up to.

The Faqs On This Page Provide Details On How Tax Reform Affects Estate And Gift Tax.

Erskine | sep 22, 2023.

The Gift Tax Limit Is $18,000 In 2025.

A sneak peek at the potential 2025 estate and gift tax rates.