How Much Can I Contribute To An Ira In 2025

How Much Can I Contribute To An Ira In 2025. You can only transfer up to the annual limit into the roth ira, so you can’t move the. The irs limits how much you.

Your personal roth ira contribution limit, or eligibility to. You can contribute only as much.

Anyone Can Contribute To A Traditional Ira, But Your Ability To Deduct Contributions.

If you are upskilling and seeking an exponential increase in your income, you might not be eligible to make direct contributions to a roth ira forever.

You Can Only Transfer Up To The Annual Limit Into The Roth Ira, So You Can’t Move The.

Explore traditional, sep, simple, and spousal ira contribution limits.

How Much Can I Contribute To An Ira In 2025 Images References :

Source: www.finplans.com

Source: www.finplans.com

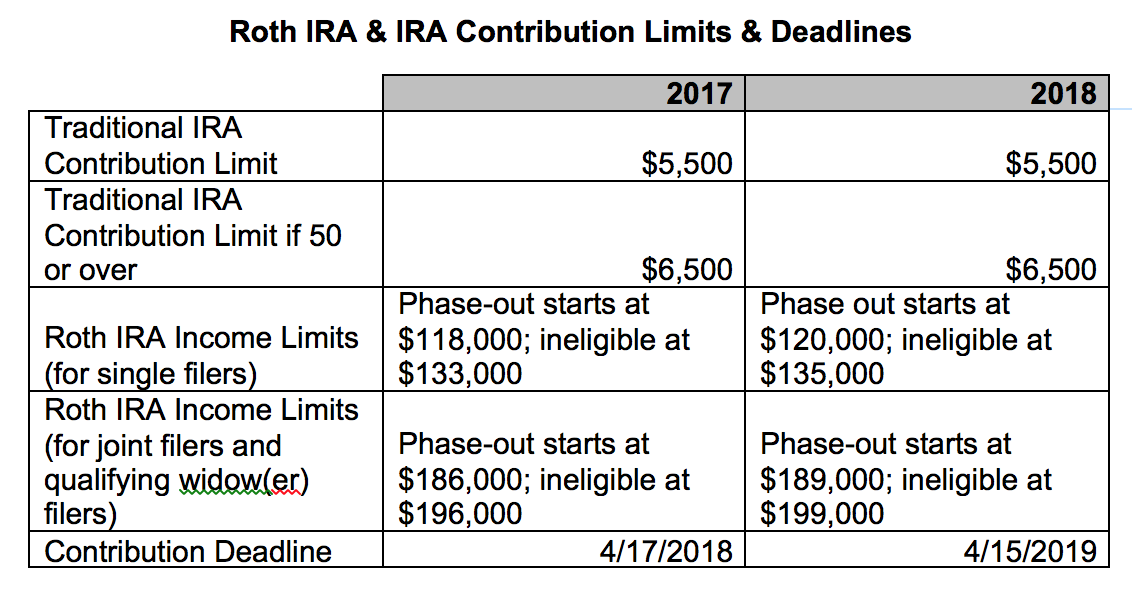

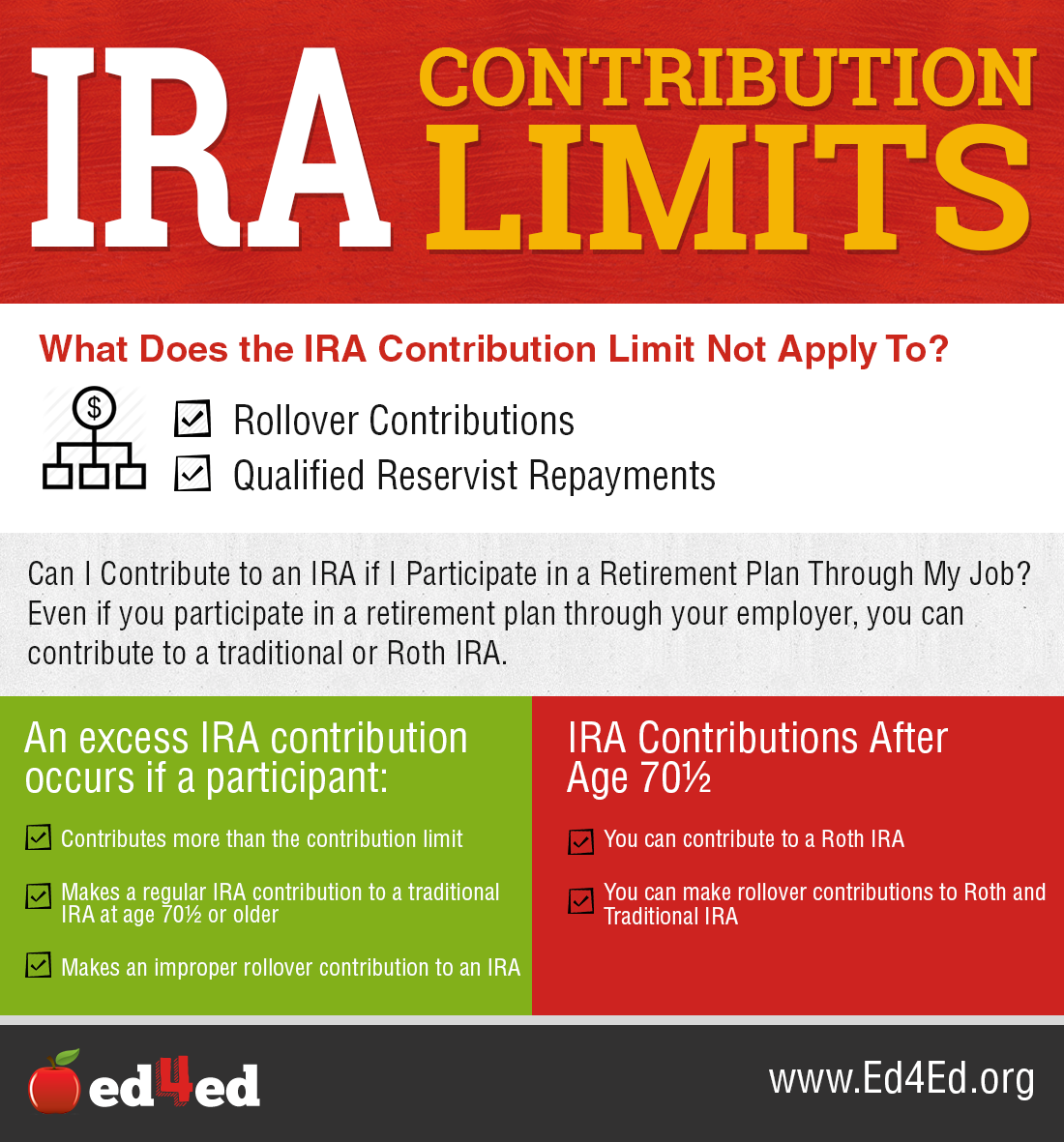

Reminder IRA Contribution Deadlines Financial Plans & Strategies, Inc., Use nerdwallet's free roth ira calculator to estimate your balance at retirement and calculate how much you are eligible to contribute to a roth ira. For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older.

Source: brunhildawelva.pages.dev

Source: brunhildawelva.pages.dev

How Much Can I Contribute To An Ira In 2024 Milli Suzanne, You can contribute to an ira at any age. Married medicare beneficiaries that file separately pay a steeper surcharge because.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Benefits Of A Backdoor Roth IRA Financial Samurai, The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Get answers to all your questions about how much money you can put into your iras this year.

Source: gwynethwbev.pages.dev

Source: gwynethwbev.pages.dev

When Can I Contribute To Roth Ira 2024 Tobye Leticia, Americans who are 50 or older can contribute an additional $1,000 in. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: www.savingtoinvest.com

Source: www.savingtoinvest.com

Roth IRA contribution limits — Saving to Invest, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. For 2025, it would be thursday, january 2nd.

Source: kellyannwalvina.pages.dev

Source: kellyannwalvina.pages.dev

Ira And Roth Ira Limits 2024 Minda Sybilla, Married medicare beneficiaries that file separately pay a steeper surcharge because. The first business day of the year is the first day you can contribute to that years' ira.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2022 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, The maximum total annual contribution for all your iras combined is: How much can you contribute toward an ira this year?

Source: visual.ly

Source: visual.ly

IRA Contribution Limit Visual.ly, For 2025, it would be thursday, january 2nd. Catchup and simple plan contributions.

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, If you earn $100,000 in 2024 and contribute $23,000 to your 401(k), your taxable income drops to $77,000. You can only transfer up to the annual limit into the roth ira, so you can’t move the.

Source: feneliawginni.pages.dev

Source: feneliawginni.pages.dev

Roth Ira Contribution Limits Calendar Year Denys Felisha, How much can you contribute toward an ira this year? The roth ira income limits are less than $161,000 for single tax filers and less than.

Anyone Can Contribute To A Traditional Ira, But Your Ability To Deduct Contributions.

Find out using our ira contribution limits calculator.

You Can Contribute Only As Much.

If you are upskilling and seeking an exponential increase in your income, you might not be eligible to make direct contributions to a roth ira forever.

Posted in 2025